International CSOs not happy after London anti-corruption summit

Some international civil society organisations concerned with corruption, financial secrecy and global tax avoidance appear to be only partly pleased with the outcome of the London anti-corruption summit.

Susana Ruiz, a tax expert with UK-based international charity network Oxfam which took part in setting up a “tax haven” at Trafalgar Square in London during the summit, was quoted saying after the summit: “Tax dodgers can still sleep easily tonight.”

Oxfam described the anti-corruption summit’s outcome as an “underwhelming response” and said the positive measures announced by governments at the summit do not provide the solution that the problem of global tax abuse demands.

“Tax abuse is an international business. Unless all governments, including tax havens, commit to a global public register showing who really profits from shell companies – where ever they are based – the corruption and tax dodging revealed by the Panama Papers will continue undisturbed.”

“If governments continue with a piecemeal response, people across the world – including some of the world’s poorest people – will pay the price. Tax dodgers are cheating poor countries out of $170 billion in taxes every year. A fraction of this money could fund health services that could save the lives of almost 150 million children,” Oxfam said.

Publish What You Pay, the advocacy network for financial transparency in the extractive industries, said the summit marked useful progress and had some positive outcome but was “not ambitious enough” in its proposals on trading transparency.

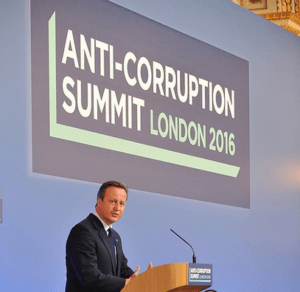

Tax Justice Network also said the UK government “failed to deliver a decisive blow against financial secrecy” and UK Prime Minister David Cameron failed in compelling or convincing the UK’s overseas territories to end corporate ownership secrecy.

The group said while it was good news that Nigeria, Kenya, Afghanistan, France, the Netherlands and others, made commitments to public beneficial ownership registers, “the bad news is that the UK’s Overseas Territories and Crown Dependencies have comprehensively failed to meet the standard set by the UK.”

“That was the absolute minimum, and entirely within the UK government’s hands to deliver,” the group wrote.

A day after the summit, Tax Justice Network also tweeted: “The anti-corruption summit is over. Back to business as usual for the UK and its satellite havens.”

The tweet was accompanied by the hashtag #DaveWasNotSerious, an obvious expression of its dissatisfaction with David Cameron.

The Network said that the UK missed a huge opportunity especially in the wake of the Panama Papers, since it still offers some secrecy for trusts and foundations, and its overseas territories only intend for now, to go as far as having registers that are not public.

The group is opposed to Britain’s stance that it can only persuade its tax haven dependencies and overseas territories to change and believes the UK could do so “simply by summoning the political will.”

Tax Justice Network also noted that the United States, 3rd on its Financial Secrecy Index, made no commitments to automatic information exchange – Secretary of State John Kerry simply spoke about the dangers of financial secrecy without making commitments.

In a statement issued after the summit, Transparency International welcomed the commitments at the summit but warned that there is more to do and concrete actions must start immediately.

By Emmanuel Odonkor

Copyright © 2016 by Creative Imaginations Publicity

All rights reserved. This article or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in reviews.