Ghana’s public debt rises 241% under Akufo-Addo

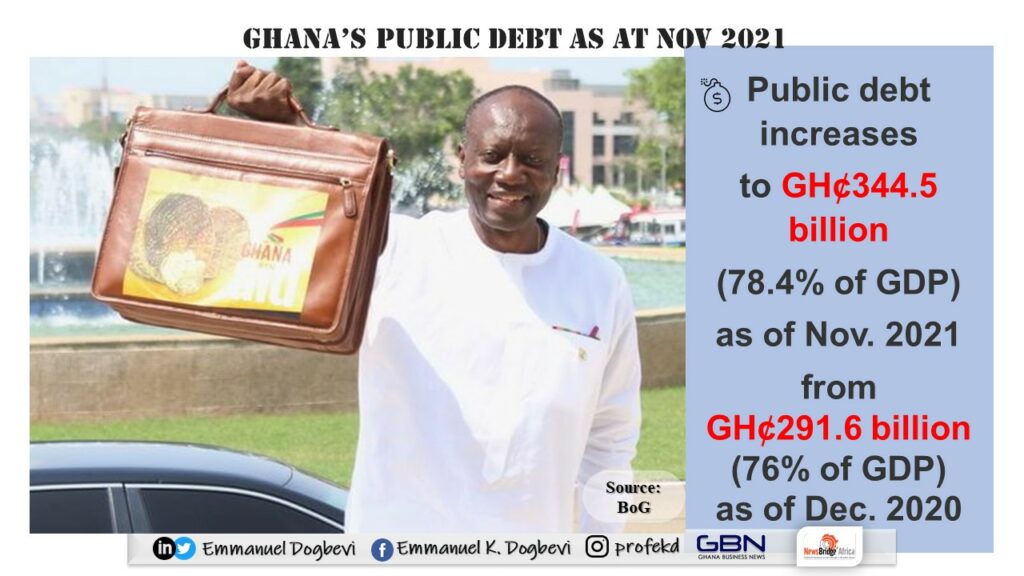

Akufo-Addo became president of Ghana on January 7, 2017 for his first term. By the end of that year Ghana’s public debt was GH¢142.6 billion but by November 2021, the debt increased 241 per cent to GH¢344.5 billion.

Akufo-Addo became president of Ghana on January 7, 2017 for his first term. By the end of that year Ghana’s public debt was GH¢142.6 billion but by November 2021, the debt increased 241 per cent to GH¢344.5 billion.

Ghana as result has been described as being at high risk of debt distress, and that means the country is unable to fulfil its financial obligations – in other words, the country can’t pay its debts.

The Bank of Ghana reports that the country’s public debt has increased to GH¢344.5 billion, which is 78.4 per cent of GDP at the end of November 2021, compared with GH¢291.6 billion, or 76.0 percent of GDP at the end of December 2020.

The domestic debt was GH¢179.4 billion (40.8 percent of GDP), while the external debt was GH¢165.1 billion (37.6 percent of GDP).

Before downgrading the country in January 2022, the rating agency, Fitch had warned in November 2021 that Ghana’s effective loss of access to international markets increases risks to its ability to meet medium-term financing needs.

The agency acknowledging that Ghana has sufficient liquidity to cover near-term debt servicing without market financing, however, warned that there is a danger that non-resident investors in the local bond market could sell their holdings, particularly if confidence in fiscal consolidation weakens, placing significant downward pressure on its reserves.

The agency acknowledging that Ghana has sufficient liquidity to cover near-term debt servicing without market financing, however, warned that there is a danger that non-resident investors in the local bond market could sell their holdings, particularly if confidence in fiscal consolidation weakens, placing significant downward pressure on its reserves.

Citing that Ghana issued $3 billion in Eurobonds in March 2021, and received $1 billion in IMF Special Drawing Rights, Fitch said the government had indicated plans to issue a further $1 billion on international markets in 2021, but abandoned the plans in October, noting market conditions.

According to Fitch, the widening of Ghana’s spreads reflects growing international investor risk aversion, partly because markets now expect US monetary tightening to come sooner than previously anticipated, making it harder for vulnerable sovereigns to attract external financing.

In January 2022, Fitch downgraded Ghana to B Negative with Negative Outlook. The agency announced it has downgraded Ghana’s Long-Term Foreign Currency Issuer Default Rating (IDR) to B Negative from B, and the Outlook is Negative.

According to Fitch, the downgrade of Ghana’s IDRs and Negative Outlook reflect the country’s or sovereign’s loss of access to international capital markets in the second half of 2021, following a pandemic-related surge in government debt, noting that this comes in the context of uncertainty about the government’s ability to stabilise debt and against a backdrop of tightening global financing conditions.

“In our view, Ghana’s ability to deliver on planned fiscal consolidation efforts could be hindered by the heavier reliance on domestic debt issuance with higher interest costs, in the context of an already exceptionally high interest expenditure to revenue ratio,” it said.

Fitch states that Ghana’s effective loss of market access to international bond markets increases risks to its ability to meet medium-term financing needs, which in the view of Fitch, Ghana has sufficient liquidity and other available external financing options to cover near-term debt servicing without Eurobond issuance.

Dr Theo Acheampong, Economist and Political Risk Analyst had earlier told Ghana Business News: “Firstly, Ghana has the option of assessing the international financial market, however, they would have to possibly borrow at higher than 10 per cent, especially given the recent spikes in the country’s sovereign bond spreads.

Such high borrowing costs essentially close access to the international capital markets in the six-month outlook to Ghana. The second option is to have the Bank of Ghana finance the budget, but that also comes with challenges. If that happens, the Bank can’t go beyond a certain threshold as it would need to keep in strict conformity of the net domestic financing ceiling, and without significantly also affecting inflationary trends that are already beyond the Bank’s own 8.0 ± 2 inflation target range.

Ghana’s December inflation reached 12.6 per cent, according to figures published by the country’s statistical service,” he explained.

The third option available to the country, he said “would be to sell more domestic debt via Treasury Bills and other instruments, and we are already seeing that,” adding that, “whichever way the government goes, there are economic and political implications,” he said.

By Emmanuel K. Dogbevi

Copyright ©2022 by NewsBridge Africa

All rights reserved. This article or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in reviews.