Increasing adoption of electronic platforms is credit positive for Ghana banks – Moody’s

In recent times Ghana has been pursuing digitization of its economy, with growing adoption of electronic platforms by the financial sector. The mobile money sector has grown rapidly, and so is Internet banking, leading to broadening financial inclusion.

In recent times Ghana has been pursuing digitization of its economy, with growing adoption of electronic platforms by the financial sector. The mobile money sector has grown rapidly, and so is Internet banking, leading to broadening financial inclusion.

The rating agency, Moody’s says the move by Ghana is credit positive for the country’s banks.

Citing a Bank of Ghana report released on August 27, 2019, Moody’s said it showed that there are rapid growth in mobile money accounts and other electronic channels such as mobile banking apps, point-of-sale and Internet banking.

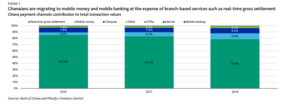

“Growing usage of these electronic payment platforms (e-platforms) at the expense of branch-based services is credit positive for Ghana’s banks because it provides new channels of revenue generation and leaner cost structures for banks, which will support banks’ efficiency and profitability,” it said.

According to the report, registered mobile money accounts increased by 36 per cent to 32.6 million in 2018, supported by 396,599 agents (the number of agents in the system doubled in 2018).

“The value of transactions on mobile money accounts increased by 43 per cent to GH¢223.2 billion. The number of mobile banking customers increased by 84 per cent to 3.9 million and the value of transactions via mobile banking platforms increased by 277 per cent to GH¢5.7 billion in 2018. The proportion of value of mobile money transactions to total transaction value in the system increased to nine per cent in 2018 from 4 per cent in 2016,” it added.

Analyzing the development, Moody’s says, financial technology (fintech) solutions such as mobile money enables greater financial inclusion, which in turn reinforces banks’ franchises through customer base growth and potential cross-selling opportunities, benefiting their revenue generation capability.

“In Ghana, some banks are investing in their fintech solutions, while others are collaborating with fintech firms. Widespread use of e-platforms will allow Ghanaian banks to expand their products and increase client transaction volume. Higher transaction volume will likely boost banks’ fee income.

E-platforms, in particular mobile and agency banking, will allow customers to open accounts and deposit their funds more easily, especially in rural areas where bank branches are few. This will support banks’ retail deposit franchises as they penetrate Ghana’s unbanked savings. Expanding mobile money is also credit positive because banks hold the float.1 In 2018, the balance on float was GH¢2.6 billion, up 13.5 per cent from 2017, and about 4 per cent of total system deposits at year-end 2018,” it said.

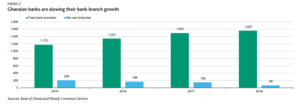

Moody’s believes that the shift towards mobile and Internet banking will also lead to lower operating costs than traditional banking.

Among other things, Moody’s argues that likely revenue improvements and lower branch-network related costs will ultimately improve Ghanaian banks’ cost-to-income ratios over the next 24 months, supporting their efficiency.

Among other things, Moody’s argues that likely revenue improvements and lower branch-network related costs will ultimately improve Ghanaian banks’ cost-to-income ratios over the next 24 months, supporting their efficiency.

“Ghanaian banks exhibit low levels of efficiency, with an average cost-to-income ratio of 80 per cent as of June 2019, down from 84 per cent in June 2018. GCB Bank Limited (B3 stable, b32 ), the only bank we rate in Ghana, introduced Internet banking last year, and has invested in digitisation platforms that we expect will continue to support its relatively higher efficiency (the bank had a cost-to-income ratio of 65 per cent as of June 2019).

Higher adoption of e-platforms, especially mobile and Internet platforms, will also allow banks to perfect their customer applications and learn to use customer data more effectively,” Moody’s said.

By Emmanuel K. Dogbevi

Copyright ©2019 by Creative Imaginations Publicity

All rights reserved. This article or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in reviews.