IMF tells Ghana to tackle increasing debt and governance issues

The International Monetary Fund (IMF) has told the Ghana government to pursue efforts to tackle the country’s remaining challenges which include high debt, large fiscal risks from the energy and financial sectors and governance issues.

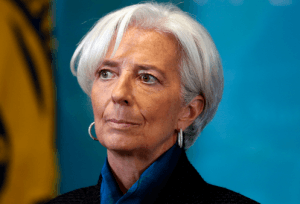

In a press statement following the visit of the IMF Managing Director, Christine Lagarde, the Fund commended the Ghanaian authorities for what it describes as their good track record under the IMF-supported programme but encouraged them to tackle the listed issues.

Ghana’s debt stock has reached over GH¢170 billion as at November 2018 and the country’s financial sector is in crisis with the collapse of five major commercial banks and several financial sector companies.

The country has been noted to have become highly lawless under the current government as party loyalists who break the law, go unpunished.

“I commended the Ghanaian authorities for their good track record under the IMF-supported program. I encouraged them to pursue efforts to tackle the remaining challenges, including high debt, large fiscal risks from the energy and financial sectors, and governance issues.

“Increasing revenue mobilization, preserving financial stability, improving management of the energy sector, and implementing responsible policies will help anchor investors’ confidence,” Lagarde was quoted as saying in the press stamen copied to ghanabusinessnews.com.

Lagarde promised, “The IMF will remain fully engaged in Ghana’s ongoing efforts to foster prosperity and opportunities for all. Credible and sustainable policies will support Ghana’s leadership position in the region.”

By Emmanuel K. Dogbevi

Copyright ©2018 by Creative Imaginations Publicity

All rights reserved. This news item or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in reviews.