IMF calls on China to improve corporate governance, as total debt equals 225% of GDP

The International Monetary Fund (IMF) is calling on China to improve corporate governance because despite the country’s reforms over the years, the reforms have done more to liberalize economic activity, creating markets and freedom to compete, than to impose disciplines and hard budget constraints on borrowers.

The International Monetary Fund (IMF) is calling on China to improve corporate governance because despite the country’s reforms over the years, the reforms have done more to liberalize economic activity, creating markets and freedom to compete, than to impose disciplines and hard budget constraints on borrowers.

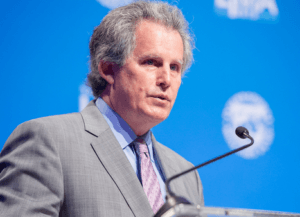

In a speech delivered at the China Economic Society Conference On Sustainable Development in China and the World in Shenzhen, China, David Lipton, First Deputy Managing Director, IMF, noted that overall, China’s total debt is equal to about 225 per cent of GDP.

“Of that, government debt represents about 40 per cent of GDP. Meanwhile, households are about 40 per cent. Both are not particularly high by international standards. Corporate debt is a different matter: about 145 per cent of GDP, which is very high by any measure,” he said.

Mr. Lipton notes that while, China’s reforms over the past several decades have been sweeping and widespread, those reforms have done more to liberalize economic activity, creating markets and freedom to compete, than to impose disciplines and hard budget constraints on borrowers.

“In short, to shore up governance. The lesson that China needs to internalize if it is to avoid a repeating cycle of credit growth, indebtedness, and corporate restructuring, is to improve corporate governance,” he said.

He argues, however that, governance must be based on a robust legal framework: the laws and regulations that establish an effective system of insolvency and enforcement that help create payment discipline.

“But governance also means regulatory and supervisory policies that promote the proper assessment and pricing of risk at the individual loan level. It means robust accounting, loan classification, loan loss provisioning, and disclosure rules. It means a system that avoids moral hazard,” he adds.

Mr. Lipton posits that governance is not just a matter of laws on the books. It is also about how laws and regulations are implemented.

“It is the impartiality that transcends special interests and connections. It is the commitment to fix flaws in the system as they emerge—and not when they cause a crisis. And it is a matter of strengthening the institutions of corporate governance, particularly to enhance shareholder rights and make public disclosure a priority. All of these factors protect creditors—and borrowers—and ensure that the gears of the financial system operate smoothly,” he said.

He believes that in a system with state-owned enterprises, proper governance also becomes a matter of making companies live within their means and ending government subsidies, including by enforcing hard budget constraints. This is what Poland and other countries in Central Europe did in the 1990s as they made the transition to a market economy. It was an effective approach that helped create impressive and durable economic success stories.

Download the full speech here.

By Emmanuel K. Dogbevi