Financing gap for African businesswomen is $42b – AfDB

Women make the biggest number of Africa’s 1.2 billion population; women are also considered to play decisive roles in securing Africa’s food security – they grow most of the crops for domestic consumption and are mostly responsible for preparing, storing and processing food.

Providing most of the labour, it is also known that women produce more than half of all the food that is grown in sub-Sahara Africa. They produce up to 80 per cent of basic foodstuffs in the region and in the Caribbean, but they are effectively alienated from financial products – women don’t have easy access to credit and land, notwithstanding the fact that compared to men, women often pay back loans.

“Women pay back loans. They are bankable, but the banking system does not lend to them. We want to change this; we want to de-risk the financial system and allow institutions to give loans to women. Together the AfDB and the IFC are showing confidence in women’s bankability,” says Dr. Akinwumi Adesina, the President of the African Development Bank (AfDB).

The AfDB estimates that the financing gap for African businesswomen is as large as $42 billion, of which $15.6 billion is lacking for women in agriculture.

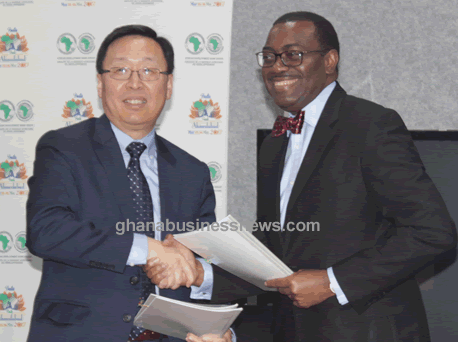

To address this financing gap, particularly for African women entrepreneurs in the agriculture sector, the AfDB and the International Finance Corporation (IFC) of the World Bank Group signed a Memorandum of Understanding (MoU) aimed at promoting investments that benefit women in Africa.

The MoU signed on Tuesday May 22, 2017, during the just ended 52nd Annual Meetings of the AfDB, in Ahmedabad, India would leverage financing for the AfDB’s Affirmative Finance Action for Women in Africa (AFAWA) programme, which aims at providing available, accessible and affordable financial services to women in business through selected financial institutions, the Bank says. The Bank hopes to leverage some $3 billion over a period of 10 years.

““Women pay back loans. They are bankable, but the banking system does not lend to them. We want to change this; we want to de-risk the financial system and allow institutions to give loans to women. Together the AfDB and the IFC are showing confidence in women’s bankability,” Dr. Adesina said at the signing ceremony.

The Bank also believes that tapping into the business potential of women, who make more than half of the continent’s population is a crucial element in achieving more inclusive and sustainable growth.

According to the Bank, the MoU is an important milestone in reducing the financing gap for female entrepreneurs on the continent.

It notes that the AfDB runs the AFAWA Programme and IFC runs the Banking on Women Programme. The two programmes, the Bank says complement each other.

“AFAWA will leverage financial inclusion instruments, capacity development, training, mentoring, information and knowledge-sharing to empower female entrepreneurs by mobilizing some $3 billion over 10 years. The Banking on Women Programme – where IFC plays a catalyzing role for partners and financial institutions – is helping to support women-owned businesses in a sustained manner.

The corporation also works with value chains of local, regional and global corporates to strengthen and broaden access to finance, training and markets for women business owners,” it adds.

Under the central theme of the Annual Meetings, “Transforming Agriculture for Wealth Creation in Africa”, The AfDB is seeking drive a Green Revolution in Africa.

The Banks is aiming at focusing on agriculture, developing all the linkages to propel its citizens into wealth and food sufficiency through evolving and developing agriculture as business.

According to Dr. Adesina, Africa must develop what it has. He pointed out that there is the need to change perceptions about agriculture as ‘dirty’.

“In Africa farmers were abandoned, in India, farmers were supported to bring about a green revolution. We have to promote subsidies to our farmers,” he said.

According to Jingdong Hua, the IFC Vice-President and Treasurer, India is the IFC’s key destination not only for overall investments but also for local currency lending.

He indicated that by mainly investing in Indian rupees, the IFC is able to reach out to women entrepreneurs.

“The IFC will be with the AfDB under the leadership of President Adesina every step of the way to implement the High 5 Agenda. Agriculture and women entrepreneurship are two areas of expertise of the IFC and this MoU is a unique opportunity to scale financing for women in agriculture,” he said.

By Emmanuel K. Dogbevi, back from Ahmedabad, India

Copyright ©2017 by Creative Imaginations Publicity

All rights reserved. This news item or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in reviews.