Finance Minister optimistic tax measures will boost revenue collection

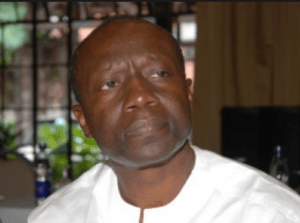

The Minister of Finance, Mr Ken Ofori-Atta is optimistic that the measures outlined in the budget would help ensure efficiency in revenue collection and offset any shortfalls because of tax reliefs.

He said government was sure to increase revenue through the reduction in tax exemptions and plugging of loopholes, which could help the Ghana Revenue Authority to collect 33 per cent more revenue in 2017 than in 2016 year.

Mr Ofori-Atta, presenting the first budget of the Akufo-Addo regime, announced government’s decision to abolish more than 10 nuisance taxes.

These include the one per cent special import levy, the 17.5 per cent VAT/NHIL on financial services, the 17.5 per cent VAT/NHIL on selected imported medicines that are not produced locally and the 17.5 per cent on domestic airline tickets.

Speaking at a post-budget forum in Accra, Mr Ofori-Atta said the measures would ensure that would get more than the GH¢1 billion revenue to be lost due to the tax reliefs granted in the budget.

The forum was organised by accounting and advisory firm PricewaterhouseCoopers (PwC) as part of its thought-leadership programmes to help the private sector and clients to better understand the budget.

Mr Ofori-Atta said government’s decision to introduce pre-approval and audit for all tax exemptions would cut by about half the amount of GH¢ 2.4 billion granted in exemptions last year.

Again, the government would convert the $2.4 billion annual interest payment on debts into a long-term treasury instrument, which should also help free about GH¢ 1 billion every year to support government

programmes, he added.

The Minister said the 2017 budget was prepared as part of government’s commitment to reenergise the private sector to join hands with the government to build the most business-friendly and industrialised economy in Africa that would be capable of creating decent jobs and prosperity for all Ghanaians.

The Country Senior Partner of PwC, Mr Vish Ashiagbor, in his highlights described the budget as business friendly and ambitious,saying it was exactly what was needed to stimulate growth.

He said the budget sought to deal with some of the structural challenges that militate against the growth of the private sector.

He urged the Ministry of Finance and government machinery to ensure strict implementation of the measures outlined in the budget.

An Associate Director, PwC, Mr Abeiku Gyan-Quansah, who outlined how the tax policies in the budget, called on the GRA to introduce an alternative dispute resolution to quickly deal with any tax conflicts that might arise between the collector and the taxpayer.

The PwC also called for the full implementation of the Tax Identification Number (TIN), using provisions, which would make TIN a precondition for dealing with institutions such as banks, the courts and other government agencies.

Source: GNA