Post COVID-19 policy actions required to reform financial systems – Expert

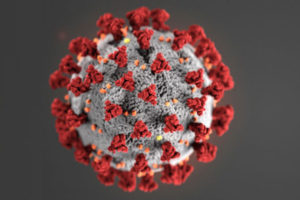

A Financial Economist, Professor Joshua Yindenaba Abor, has called on African Governments to implement early and ambitious financial policy responses and reforms to minimise the impact of the COVID-19 pandemic.

A Financial Economist, Professor Joshua Yindenaba Abor, has called on African Governments to implement early and ambitious financial policy responses and reforms to minimise the impact of the COVID-19 pandemic.

“COVID-19 is here to stay and its impact will be with us and the pressure is on to address the ongoing issues in addition to dealing with the existing challenges,” he said.

“There is the need to implement early and ambitious policy responses and reforms in the financial system to address the situation or minimise the impact,” he added.

He said though African Governments provided some monetary and fiscal policy responses to the COVID-19 pandemic, there was the need for other policy actions to ensure that the continent’s financial systems could spur growth in the post-COVID-19 era.

Prof Abor gave the advice during a lecture organised by the Department of Economics, Faculty of Social Science and Arts of the Simon Diedong Dombo University of Business and Integrated Development Studies.

He spoke on the topic: ‘COVID-19 pandemic and Africa’s financial systems: How do we reform the post-COVID-19 financial systems?’.

Prof Abor said governments played important roles in every financial system and could not stay back completely from participating in the financial market, adding governments must be concerned about ensuring stability in the system.

Prof. Abor said Development Banks were used by developed countries to grow their economies, especially during a crisis and encouraged African Governments to establish National Development Banks to provide support to underprivileged sectors, including SMEs.

“Even in the developed countries, that is how they grew their economies. SMEs are always the engine of growth and they represent about 92 per cent of businesses in Ghana and Africa as a whole. So if we do not serve this sector, we will not go anywhere,’ he said.

Prof Abor said with the COVID-19 situation, SMEs in Africa could not depend on banks that served only the elites in society and large corporates and indicated that the best way to go was to set up specialised banks to support them.

In that regard, Prof. Abor commended the Government for taking steps to establish the Development Bank of Ghana and said the best model must be adopted to ensure that the desired impact was felt at the specific sectors of the economy.

The modelling is very important and the idea is fantastic. It is very needed in our markets because there are some sectors such as the SMEs that are not able to access formal financial services. So if you are setting up a National Development Bank to support them, that is fantastic.

“The modelling must be looked at so that the desired impact will be felt”, he added.

Prof Abor further encouraged African governments to promote macroeconomic stability, implement effective regulatory and supervisory frameworks and encourage financial market development through effective market infrastructure.

He also advised African governments to encourage institutional investments, saying the financial system thrived when there were many institutional investors such as life insurance companies and pension funds

He added that banks must also be encouraged to invest in the long term and desist from the practice of finding cheap ways of making returns.

Prof Abor admonished African Central Banks not to be only interested in regulations and monetary policies but to show interest in financial literacy and support under-privileged sectors of the economy to develop.

The Vice-Chancellor of the University, Prof. Philip Duku Osei, applauded Prof. Abor for his insight into how African governments could reform their financial systems to deal with the ravages of the COVID-19 Pandemic.

He also thanked Prof. Abor for donating books to Faculty and the University Library.

The Vice-Chancellor further thanked the organisers of the programme and called for more such events to be organised to stimulate intellectual engagements and enhance the impact of the University on society.

Source: GNA