Jean-Louis Chanel: The Frenchman who sold timber from Ghana

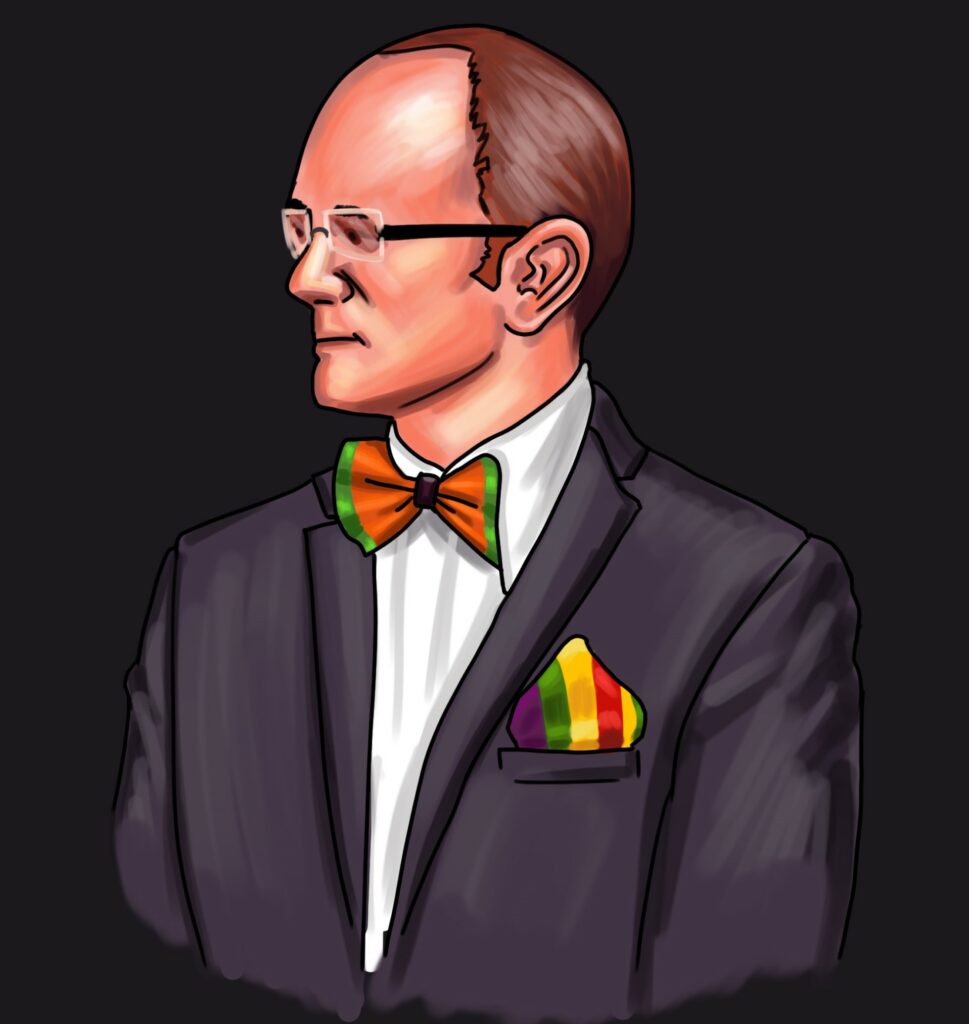

Jean-Louis Chanel is the name of a former France-Ghana business counsellor listed in the Panama Papers, among thousands of other names linked to the infamous law firm Mossack Fonseca. Despite his name appearing in the leaks in 2016, his appointment as counsellor was renewed up to November 2019. He was even awarded the French Order of Merit in recognition of 36 years of service to the French State.

Appearing in the Papers does not suggest wrongdoing, and in France, there isn’t any law forbidding high ranking officials from owning offshore companies, as long as they’re established abroad. Nonetheless, how does France consider someone with links to a tax haven as the suitable representation of its values abroad? And was this shell company owned by Chanel in full compliance with Ghana tax regulations at the time ? What kind of business activity was it involved in?

A multifaceted businessman

Chanel surely wore many hats in 2016. In addition to his role as special advisor on French-Ghana business relations, he was also a vice-president of the French Chamber of Commerce and Industry in Ghana; a recognized “Knight” of the Order of Merit, as well as the director of the Sylva Spare Plus, back then a Renault Trucks concessionaire.

He was also, less officially, the ultimate owner of the offshore company “Sylvafrica”, based in Seychelles, as revealed by the Panama Papers dataset published in April 2016 by the International Consortium of Investigative Journalists and its partners worldwide.

In additional company fillings shared by the ICIJ about Sylvafrica, the financial activity of the company is described as “import of trucks and other transportation equipment”. Could the concessionaire have used Sylvafrica in order to escape corporate taxes, or to optimize them?

When he was contacted by our newsroom, Chanel denied any kind of link between Sylvafrica and Sylva Spare Plus: “I have paid all my taxes in Ghana regarding my salary as a director of Sylva Spare Plus, and this company has nothing to do whatsoever with Sylvafrica,” he said.

According to the former business advisor, Sylvafrica served him for yet another purpose, and yet another role he had in addition to all the aforementioned ones, as a consultant in wood export. For this activity however, he was evasive. Did he pay taxes in Ghana based on this consultancy activity? How much money was made from it, before being sent to Seychelles? These questions, he didn’t wish to answer. However, few more elements can be found about Sylvafrica.

Fruitful transactions at the time of unregulated wood exports

The correspondence shared between Jean-Louis Chanel and Mossack Fonseca clearly states another business activity behind Sylvafrica, as “timber trading” and “export”. More than a consultant, was he also exporting wood? Here again, the former French official denied, until he was confronted with two bills of lading retrieved from the customs of Algericas (Spain) and Abidjan (Ivory Coast) by several private companies specialized in global trade.

The information indicates that a company called “Sylvafrica Trading Limited”, linked to a Ghanaian address exported around 80 tons of the timber species Khaya Ivorensis, also known as the African Mahogany, for an estimated value of around €94,000 at the time of the shipments, back in 2007.

Its owner, Chanel then backpedals on his previous position and acknowledges an activity of timber trade from 2000 to 2010 in addition to his timber trade consultancy activity. However, he does not remember these specific transactions, suggesting that someone else “might have used his company.” An interesting hypothesis that could free him of any responsibility regarding these transactions, but that he wasn’t able to prove in any way.

At the turn of the 20th Century, Ghana’s forests covered around 8.2 million hectares of land. By the late 1980s, the forest cover has shrunk to less than 18,000 km2, which means a reduction of the forest cover to 2.1 million hectares.

By the year 2007, the forest cover of the country has been reduced significantly to 1.6 million hectares. Forestry sources say since independence from Great Britain in 1957, the annual rate of forest loss has been averaging 65,000 hectares yearly.

And according to the Food and Agriculture Organisation (FAO) of the United Nations, between the year 2000 and 2005 Ghana lost an average of 115,400 hectares of forest per year.

The country’s rich forests contribute about 10 per cent of GDP and it is 15 per cent of merchandise exports.

According to the Environmental Investigation Agency [EIA] and their 2018 report on criminal deforestation in Gabon and Congo, the export of wood through offshore companies can be an indicator of illegal wood trafficking. An activity with great negative environmental impact in a country such as Ghana where deforestation has increased exponentially since 2000, with an increase rate of 60 per cent in primary forests in 2018, according to Global Forest Watch.

Was the wood exported through Sylvafrica of a legal and traceable origin? Chanel confesses himself, that at the time of this activity, Ghanaian regulations on timber were not as developed as they are today, and that prevented him from ensuring a systematic verification of the origin of the wood he used to export.

Was Jean-Louis Chanel, a “victim” of the Panama Papers?

Due to the lack of information in Ghana and neighbouring countries in the early 2000’s, very few bills of lading can be found mentioning Sylvafrica. But the ones found in Spain in Algericas and Abidjan do prove however a trading activity in timber, for which Chanel has not made clear if he had paid corporate taxes or not in Ghana.

This represents an obvious ethical issue in a developing country such as Ghana, which economy relies largely on taxes (80 per cent of its public revenue in 2017 according to the OECD).

Moreover, considering the legal dimensions, tax evasion would be a necessary conduct subject to prosecution as well.

While Chanel does admit some “carelessness” into choosing Mossack Fonseca as a law firm to open his offshore company, he does not seem to be aware of the legal and ethical problems that poses.

“All I can tell you is that I paid many taxes for my former job as a company director with Sylva Spare Plus; lots of taxes. For the rest, I might be listed in the Panama Papers, but I’m not a multi-billionaire comfortably smoking a cigar on my yacht. I’m a victim of the Panama Papers.”

Big or small tax avoiders however, all invariably contribute to a global loss of €350 billion that’s approximately $41 billion for countries around the world.

Regarding the French institutions’ decisions to maintain Chanel in his position despite being listed in the Panama Papers, none of them have wished to comment, from the French Chamber of Commerce to the Prime Minister’s office who awarded him the Order of Merit in April 2016, one month after the publication of the leaks.

Chanel has since resigned from his position at the start of this investigation in November 2019. It is now Mathieu Castre, former manager of Sylva Spare Plus, who holds the public position of special advisor to France-Ghana business relations.

By Emmanuel K. Dogbevi & Alexandre Brutelle

This investigation was made possible with the support of the Money Trail project (www.money-trail.org)