Moody’s says Bank of Ghana action over UniBank is credit positive for Ghanaian banks

The rating agency, Moody’s says the decision by the Bank of Ghana (BoG)to place the country’s third largest bank by assets, UniBank under administration is credit positive for Ghanaian banks.

The rating agency, Moody’s says the decision by the Bank of Ghana (BoG)to place the country’s third largest bank by assets, UniBank under administration is credit positive for Ghanaian banks.

Moody’s in an email copied to ghanabusinessnews.com says the action signals a stricter regulatory stance.

The central bank last Tuesday announced that it had placed UniBank Ghana Limited, under administration because of its negative capital and persistent liquidity challenges.

“The Bank of Ghana’s action is credit positive for the country’s banks because it’ll enhance their long-term financial stability by removing weaker banks from the system and underscores the central bank’s stricter enforcement of prudential guidelines. A stricter regulatory stance will lead to more reliable reporting and greater visibility on banks’ true economic positions,” says Peter Mushangwe, Moody’s African banking analyst.

Moody’s notes that UniBank is the first large bank that the BoG has placed under administration following its system-wide asset quality review in 2016.

The Bank appointed KPMG as the Official Administrator, and the regulator says the action is aimed at saving UniBank from imminent collapse.

“It will prevent potential losses to depositors and other creditors, and ensure that the financial condition of the bank does not create further risks for the entire financial system. KPMG as Official Administrator will assume control of the bank and all its branches and carry out the responsibilities  of the shareholders, directors, and key management personnel of UniBank with effect from today.

of the shareholders, directors, and key management personnel of UniBank with effect from today.

In line with its powers under Act 930, KPMG will ascertain the state of the bank’s assets and liabilities, and exercise a variety of powers under Act 930 to rehabilitate and return the bank to regulatory compliance and viability within a period of six months, at the end of which the bank will be returned to private ownership and management,” the Bank said.

During the period of the official administration, the bank will however remain open for business under the management and control of KPMG overseen by the Bank of Ghana, and is not being closed and liquidated, it reiterated.

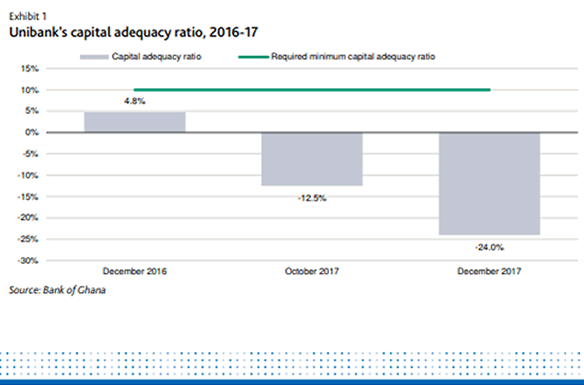

The BoG’s intervention, Moody’s pointed out follows UniBank’s failure to restore its capital adequacy ratio to the required 10 per cent and its strained liquidity among several other regulatory breaches.

The central bank states that UniBank’s capital adequacy ratio had deteriorated to negative 24.0 per cent as of December 2017, from 4.8 per cent in 2016 because of high nonperforming loans and high asset growth.

“The bank’s capital shortfall was GH¢1.18 billion as of year-end 2017,” it said.

By Emmanuel K. Dogbevi

Copyright ©2018 by Creative Imaginations Publicity

All rights reserved. This news item or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in reviews.