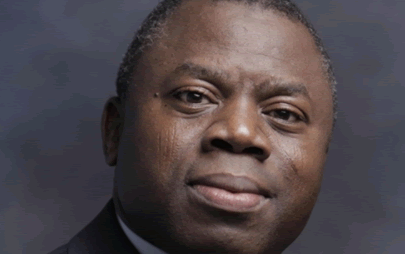

Time to fully embrace a cashlite economy – Andani

There seems to be some way out of the recent spate of robberies apparently fueled by the presence of cash according to Alhassan Andani, Chief Executive of Stanbic Bank. He says going cashlite may be a way out of the difficulty. According to the President of the Ghana Association of Bankers, only some 20-25 per cent of total payments in Ghana are currently done by other means apart from cash.

“Cash is still king and this covers all the physical notes and cheques that are given to individuals and many smaller companies on a daily basis to complete most transactions in the economy,” he said.

He added that cash is always a source of attraction to robbers. “Without a pool of cash, there is no incentive for most criminals. To the extent that the reward is large, people will take risks. Once this is removed and not available for easy pickings, no one plans or schemes on how to attack you to collect what you have thereby reducing the incidence of violence around us.”

He indicates that the country is already on the cashlite route and possibly the latest bad news is what may shove the country further down that lane.

Indeed there are a large number of products and services that the financial sector has rolled out to enable Ghana to go cashlite or the related concept of cashless.

There are currently on the market products such as cards and Point of Sales devices. The cards are either debit or credit cards which can be accessed by customers of banks. There is also a full range of mobile money solutions that allow customers of the telecoms companies to collect or pay money using this channel. This sector of the economy is a huge mover of money with at least 17 million active mobile money users, a figure that is more than the total banking population in Ghana.

Merchants can collect payments on so-called soft POSs which allow the merchants to receive money on any Internet enabled device. There is also the traditional POS which helps to eliminate cash transactions by using cards.

In the same segment of the market, there are USSDs that have been deployed for very specific services for some merchants where each merchant is given a unique USSD string code that their customers can dial and use to pay for goods and services using mobile money.

Another entrant to the market is what allows customers to fund their mobile money or bank account with their mobile money system, and this helps to take cash out of the equation.

Adopting a cashlite economy would lead to efficiency in the completion rates of transaction because cashlite is almost an instant payout.

“We will have a higher volume of completion of transactions which will drive efficiency. We will also have less litigation over transactions as the chances for losses are minimal. Cashlite and therefore more digital payment platforms provide a lot more certainty in transfer of value and receipts. There is also ease of reconciliation because the system is almost self reconciling,” Andani said.

To the financial sectors and its customers, “a cashlite society would largely eliminate the whole industry of managing cash, the cost of which is of no real value addition to the sector nor to the custormer, not to talk about the security around protecting this cash against people who have the incentive to attack people for physical notes,” he added.

The future of banking and payments may have arrived – as payments have increasingly become personalised. In the future one may receive a very specific note that says a bill is due in two days, the message may ask for permission to debit an account and this can be done with the click of a button.

Such a future will be driven by data and insights.

By James Dadzie