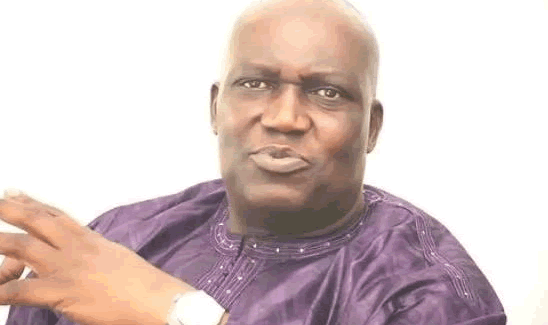

Ghana’s economy still fragile – Ken Thompson

Mr Kenneth Thompson, Chief Executive Officer of Dalex Finance Company has described Ghana’s economy as fragile and bedevilled with huge challenges.

He said the economy could crumble under any major economic shock such as crop failure or sharp fall in commodity prices.

Mr Thompson in a mid-year review of the economy with the Ghana News Agency in Accra, urged the government to marshal all resources to fight against the invading Fall army worm as “it is an economic and security threat to the nation”.

The army worm has been found in the Eastern, Brong Ahafo, Ashanti and Western Regions and had destroyed more than 5,870 hectares of maize, cowpea and cocoa since 2016.

He said in 2016, the Fall Armyworm invaded maize crops in Zambia and by January 3, 2017 about 90,000 hectares were affected, according to reports released by the Zambian government’s Disaster Management and Mitigation Unit.

Mr Thompson said the 2017 budget showed that, Ghana’s domestic revenue hit GH¢30.2 billion in 2015 and rose marginally to GH¢36.4 billion in 2016.

He said 40.7 per cent of domestic revenue was used as compensation to employees in 2015 and 46.2 per cent spent on employee compensation in 2016.

He said the government spent 30.7 per cent of domestic revenue in 2015 on interest payments, which jumped to 32.0 per cent in 2016.

Mr Thompson said Ghana spent approximately 71.4 per cent of domestic revenue in 2015 on emoluments and interest payment, which jumped to 78.2 per cent in 2016.

“We spent over 70 per cent of our income on two items. We are on the same trajectory half-year down 2017 nothing has changed…Government domestic revenue is estimated at GH¢45.0 billion, an increase of 33.5 per cent over the 2016 figures.

“Non-Oil revenue and grants projected at GH¢42.6 billion in the 2017 budget, is an increase of 29.2 per cent over 2016 and oil revenue also estimated at GH¢2.4 billion, an incredible increase of 231.2 per cent over the 2016 figures,” he said.

Mr Thompson said the size of government, the level of borrowing, low government revenue, the exchange rate, the army worm invasion, the debt at the financial sector and disposable income were bad news for the country.

He observed that the local currency was overvalued and government spent huge resources to supplement the cedi.

“If devaluation is managed, the amount saved can be used to support other key sectors of the economy,” he said.

Mr Thompson said interest rates had dropped from 32 per cent to 23 per cent and that was good for the economy if sustained, because it would promote investment.

Source: GNA