The Speaker of Parliament Rev Prof Aaron Mike Oquaye on Wednesday directed Finance Minister Ken Ofori-Atta to appear in Parliament in a week’s time to furnish the House with detailed information on the issuance of the recent $2.25 billion bond.

The directive followed a historical first half-hour motion in Ghana’s parliamentary democratic practice.

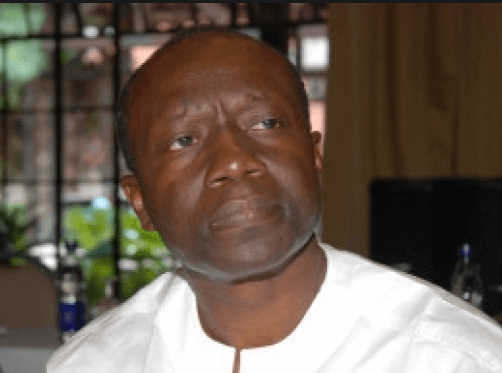

The motion was moved by Minority Leader Haruna Iddrisu for the House to prevail on “the Minister responsible for Finance to provide detailed information on the recent $2.25 billion bond including the full complement of documentation related to the issuance, the participants, the utilisation of the proceeds and the currency in which the Bond was settled.”

Government last month (April 2017) announced that it had successfully auctioned a total of $2.25 billion in four bonds.

The first two bonds, totalling $1.13 billion, was issued at 15 and 7 years period with the same coupon of 19.75 per cent.

In addition, the Ministry of Finance raised the cedi equivalent of $1.12 billion in 5 and 10 year bonds via a tap-in arrangement.

The Minority National Democratic Congress (NDC) has, however, since taken the ruling Government of the New Patriotic Party (NPP) to task over the financial deal, alleging among others that it was not open, not economical and financially beneficial to the state, and favoured family and friends, who were parties to it.

Minority Spokesperson and Ranking Member on Finance Cassiel Ato Forson seconded the motion.

Majority Leader Osei Kyei-Mensa Bonsu, also seconding the motion said the appearance of the Minister, currently out of the country, would help on the closure of the controversy on the bond deal.

Before giving the directive, Rev Prof Oquaye, who is also a former Head of the Political Science Department of the University of Ghana, Legon, explained features of a half-hour motion to the House.

Later at a press conference at the Parliament House, the Minority reiterated its call on Mr Ofori-Atta to make available to the House, the full complement of documentation relating to the $2.25 billion bond issued by the government.

The NDC Caucus said the circumstances on which the bond was issued were not transparent and that there were elements of insider trading.

Mr Ato-Forson, addressing the press conference said the purpose and use of proceeds of the bond transaction was to switch short term domestic instruments such as the 91-day and 182-day treasury instruments.

Rates for the instruments, Mr Forson said, was as at April 17, 2017 for 91-day bond was traded at 16.35 per cent while that of 182-day bond was going for 16.07 per cent and was therefore surprising that the Finance Minister decided to go for a long term debt of 19.75 per cent to switch off a debt of 16.35 per cent.

To the Minority NDC Caucus, the action of the Finance Minister would rather ultimately cause financial loss to the State, amounting to GHȼ330 million annually.

“Ghana would be better of the country had decided to rollover the existing bond being traded at 16.35 per cent instead of going in for the 19.75 per cent bond saving the nation millions annually, and for the next 15 years running, the country would save GHȼ5 billion,.” Mr Forson said.

He criticised the bond transaction, saying it smacked conflict of interest.

Source: GNA