Tax exemptions to investors cost Ghana GH¢2b – Minister

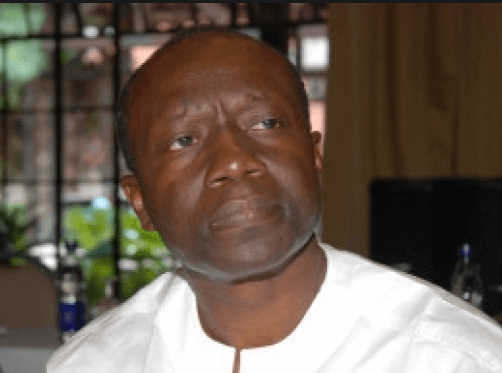

Minister of Finance, Mr Ken Ofori-Atta says his Ministry would cut down on tax exemptions, which are being abused by some investors to the detriment of the nation.

Mr Ofori -Atta condemned such malpractices, saying he had noted that the amount of exemptions had moved from GH¢800 million to about GH¢2 billion at present; a billion of which was being lost through leakages.

Addressing the maiden National Policy Summit, organised by the Ministry of Information, Mr Ofori-Atta said his Ministry was thus in the process of reviewing of these exemptions.

He said the State, which had given the exemptions in a bid to attract investments, had to find ways of restraining them since those who received them did not respect the ‘gift’ they had been given.

The Finance Minister said those who caused the situation could not blame the Ministry for deploying measures to curb this.

“…so I welcome ideas as to how to ensure that those who deserve exemptions get it and if you have it, you treasure it and that it is not abused,” he stated, adding, “It is important that we all start to be a part of the solution”.

Mr Ofori-Atta also said to increase revenues, the Ministry intended to stop leakages and simplify tax processes to ensure compliance.

It would also implement the Public Financial Management Act (PFMA) to control public expenditure and also deploy the sanctions spelt out in the Act where necessary.

The two-day Summit is to allow the Ministries to share their policies and how they would be implemented with the relevant stakeholders.

Mr James Asare Adjei, President of the Association of Ghana Industries (AGI), in an interview with the GNA, said while it was important for the Government to review and streamline the granting of tax exemptions to prospective investors, it was also critical that it did not do so on a blanket basis.

He said the move to review tax exemptions should take into consideration indigenous businesses, especially since many of the companies that enjoyed tax exemptions were foreign ones.

“We think it is in the right direction …however we should also be mindful of the fact that there are certain businesses that the removal should not apply to,” he said.

Mr Adjei said companies in the manufacturing sector who imported equipment and other raw material inputs should not be affected by a blanket tax exemption removal.

He criticised as low the support that local businesses received from Government agencies like the Ghana Investment Promotion Council (GIPC), saying it was not comparable to what foreign investors received.

He, however, expressed optimism that the GIPC’s rebranding efforts to be more domestically focused would improve the fortunes of local businesses in getting support from the GIPC.

He said indigenous businesses should benefit from more tax exemptions as they could only borrow at high interest rates, while foreign businesses had access to much cheaper credit.

Source: GNA