MMM Ghana is Ponzi scheme, not licensed – Central bank

The Bank of Ghana has issued a statement warning the Ghanaian public that the company called MMM Ghana which has been operating a Ponzi scheme through a virtual office has not been licensed by it.

The Bank of Ghana has issued a statement warning the Ghanaian public that the company called MMM Ghana which has been operating a Ponzi scheme through a virtual office has not been licensed by it.

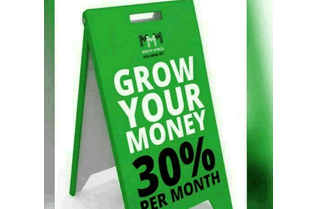

In a press statement issued today May 10, 2017 and copied to ghanabusinessnews.com, the Bank of Ghana says it wishes to draw the attention of the general public to the activities of a company called MMM Ghana, which is operating a Ponzi scheme through a virtual office.

“The company, which claims to have over 10,000 clients, moves from place to place and mobilises deposits from the general public,” it said.

According to the Bank, the institution’s operations are contrary to section 6(1) of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930) and also threatens the safety and soundness of the financial system.

“The Bank of Ghana wishes to inform the general public that MMM Ghana is not licensed by the Bank of Ghana to engage in any form of deposit-taking activity, hence anyone who does business with MMM Ghana does so at his or her own risk,” the Bank warned.

According to Investopedia, a Ponzi scheme is a fraudulent investing scam promising high rates of return with little risk to investors. The Ponzi scheme generates returns for older investors by acquiring new investors. This is similar to a pyramid scheme in that both are based on using new investors’ funds to pay the earlier backers. For both Ponzi schemes and pyramid schemes, eventually there isn’t enough money to go around, and the schemes unravel.

A similar enterprise, MMM Nigeria did operate in that country, and in March 2017, the Nigeria Deposit Insurance Commission (NDIC) revealed that Nigerians lost N18 billion to the scheme in 2016.

Sometime in 1993 two non-bank financial institutions, R5 and Pyram Ghana operated a loans and savings scheme without licence from the Central Bank. They offered rates higher than prevailing bank deposit interest rates. But the Ponzi scheme collapsed and thousands of depositors lost their savings.

By Emmanuel K. Dogbevi