Ghana government cuts, abolishes nuisance taxes in 2017 budget

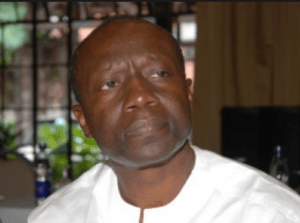

“A number of tax measures have been introduced in recent years in an attempt to deal with revenue shortfalls but some have proven to be nuisance taxes and have no revenue yielding potential and at the same time impose significant burden on the private sector and the average Ghanaian citizen,” Mr Ken Ofori Attah, the Finance Minister said, as he presenting his first budget today March 2, 2017.

The Minister argued that revenue administration remains a challenge, and suggested that to boost revenue streams, the government will strengthen tax administration, reduce tax exemptions, plug revenue loopholes and leakages and combat tax evasion.

“We will broaden the tax base whilst reducing and abolishing some taxes and levies,” he said.

He indicated that the National Identification Scheme, a priority project of the administration, which it intends to relaunch this year, will support the government’s efforts to rope in the economically active but undocumented citizens and the informal sector of the economy thereby broadening the tax base and accelerating financial inclusion.

“Mr. Speaker, we will adhere to and maintain good economic governance principles of fiscal discipline, accountability and transparency. To reiterate what the President said, we will protect the public purse by guaranteeing value for money in all public transactions, and exercising prudence and discipline in our fiscal management to deliver on the aspirations of the Ghanaian people,” he said.

He warned that inefficiencies and waste in government spending will not be tolerated and there will be strict enforcement of all relevant laws and regulations, especially the new Public Financial Management Act, 2016 (Act 921).

He outlined the government’s interventions on tax reductions to provide relief to businesses and the average Ghanaian which shall be implemented in the short to medium term.

“Mr. Speaker, a number of tax measures have been introduced in recent years in an attempt to deal with revenue shortfalls. Some have proven to be nuisance taxes. They have low revenue yielding potential and at the same time impose significant burden on the private sector and on the average Ghanaian. As part of our commitment to reenergize the private sector, Government has decided to review these taxes to provide relief for businesses,” he said.

The Minister stated that the following specific measures shall be implemented in the short to medium term:

- abolish the 1 per cent Special Import Levy;

- abolish the 17.5 per cent VAT/NHIL on financial services;

- abolish the 17.5 per cent VAT/NHIL on selected imported medicines, that are not produced locally.

- initiate steps to remove import duties on raw materials and machinery for production within the context of the ECOWAS Common External Tariff (CET) Protocol;

- abolish the 17.5 per cent VAT/NHIL on domestic airline tickets;

- abolish the 5 per cent VAT/NHIL on Real Estate sales;

- abolish excise duty on petroleum;

- reduce special petroleum tax rate from 17.5 per cent to 15 per cent;

- abolish duty on the importation of spare parts;

- abolish levies imposed on ‘kayayei’ by local authorities;

- abolish levies imposed on religious institutions by local authorities;

- exempt from taxation, the gains from realization of securities listed on the Ghana Stock Exchange or publicly held securities approved by the Securities and Exchange Commission (SEC);

- reduce National Electrification Scheme Levy from 5 per cent to 3 per cent;

- reduce Public Lighting Levy from 5 percent to 2 percent;

- replace the 17.5 per cent VAT/NHIL rate with a flat rate of 3 per cent for traders; and

- implement tax credits and other incentives for businesses that hire young graduates.

He noted that the government will also support local banks to make credit available to small and medium scale businesses.

“Mr. Speaker, while government’s focus is on reducing taxes to enhance production, we are also determined to tackle the systemic abuse in the exemptions regime. There shall be a comprehensive review of the regime on import duty exemptions and tax reliefs with a view to eliminating abuses and improving efficiency in the applications of these incentive,” he said.

To this end, the review will cover, among others, the following exemptions and tax reliefs as a matter of urgency:

- import duties, taxes and levies payable by MDAs and other government departments;

- import duties and all forms of taxes and levies payable by both domestic and foreign companies, suppliers and contractors executing projects andcontracts in the country;

- import duties and all forms of taxes and levies payable by employees, directors and senior officials of both domestic and foreign companies, suppliers and contractors executing projects in the country;

- import duties and all forms of taxes and levies payable by both domestic and foreign companies and investors doing business in the country; and

- import duties and all forms of taxes and levies payable by non-governmental and charity organisations.

By Pamela Ofori-Boateng