FDI to Ghana in 2015 drops 4.9%

Foreign direct investment (FDI) to Ghana in 2015 declined 4.9 per cent, according to the 2016 World Investment Report of the United Nations Conference on Trade and Development (UNCTAD).

Foreign direct investment (FDI) to Ghana in 2015 declined 4.9 per cent, according to the 2016 World Investment Report of the United Nations Conference on Trade and Development (UNCTAD).

The country recorded FDI inflows of $3.2 billion in 2015.

FDI to West Africa was largely weakened by low commodity prices, it said.

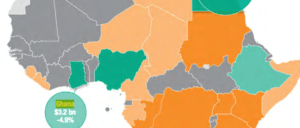

In contrast to North Africa, FDI inflows to West Africa declined by 18 per cent to $9.9 billion, largely because of a slump in investment to Nigeria, the largest economy in the continent.

Weighed down by lower commodity prices, a faltering local currency and some delays in major projects (such as Royal Dutch Shell’s multibillion-dollar offshore oil operations), FDI flows to the country fell from $4.7 billion in 2014 to $3.1 billion in 2015. Yet despite bleak economic conditions, consumer spending remained strong, which attracted FDI inflows. The German pharmaceutical company Merck, for example, opened its first office in Nigeria as part of a broader African expansion. Outside Nigeria, high cocoa prices drove FDI inflows to the region’s major exporters, such as Ghana and Côte d’Ivoire. French chocolatier Cémoi established its first chocolate processing factory in Côte d’Ivoire, the report said.

And despite a 38 per cent rise overall in global FDI in 2015 to the tune of $1.76 billion up from $1.27 billion in 2014 FDI flows to Africa fell to $54 billion, a decrease of 7 per cent over 2014.

With overall inflows declining by 7 per cent to $54 billion, Africa’s share in global FDI fell to 3.1 per cent (down from 4.6 per cent in 2014). Flows to transition economies fell further, by 38 per cent, to $35 billion.

The report indicates that an upturn in FDI into North Africa was more than offset by decreasing flows into sub-Saharan Africa, especially to West and Central Africa.

“Low commodity prices depressed FDI inflows in natural-resource-based economies. FDI inflows to Africa are expected to increase moderately in 2016 due to liberalization measures and planned privatizations of state-owned enterprises,” it said.

According to the report, FDI flows to developed economies jumped by 84 per cent to reach their second highest level, at $962 billion.

“Strong growth in flows was reported in Europe (up 65 per cent to $504 billion). In the United States FDI flows almost quadrupled, although from a historically low level in 2014,” it noted.

Inward FDI to developing economies reached a new high of $765 billion, 9 per cent above the level in 2014, and developing Asia, with inward FDI surpassing half a trillion dollars, remained the largest FDI recipient in the world.

While, FDI flows to Latin America and the Caribbean – excluding Caribbean offshore financial centres – remained flat at $168 billion.

By Emmanuel K. Dogbevi

Copyright © 2016 by Creative Imaginations Publicity

All rights reserved. This news item or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in reviews.