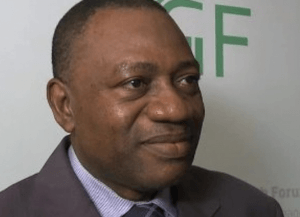

Mobilising private capital could propel Ghana’s growth – Pelpuo

Mobilising private capital to assist government in its quest for development would help put the country on a growth trajectory faster, says a Minister of State.

Dr Rashid Pelpuo, Minister of State in charge of Private Sector Development and Public Private Partnership (PPP), said private capital is more efficient in improving efficiency as well as creating sustainable jobs.

He was speaking at the two day maiden impact investing workshop in Accra on the theme: “Impact Investing: Building the field and Measuring Success.”

The workshop was organised by Venture Capital Trust Fund in partnership with GIMPA Centre for Impacting Investing, Ted Jackson and Associates, CLEAR AA and Rockefeller Foundation.

Dr Pelpuo noted that impact investing has come in to help alleviate the challenges and accelerate the growth path of Ghana’s economy.

He said there is no doubt that the blend of public, private and philanthropic capital could move the country’s developmental agenda forward.

The Minister said government in its bid to provide quality education, health care, potable water among other demands run into budget deficits.

He said it is therefore key to adopt Impact Investing that had proven to be an effective tool for mobilising a blend of public private and philanthropic capital that could create jobs and provide affordable products and services.

He cited the country’s energy situation as having affected many businesses especially small and medium enterprises, adding that was why government invited private companies to partner it to generate power for businesses.

Dr Pelpuo expressed happiness that the conference was going to focus more on evaluation, which most people fear or fail to do.

He announced the upcoming SME’s Financing Fair, which would take place on April 26 to April 27 in Accra.

According to him, the idea of the fair is bridge the information gap between financiers and SME’s as well as ease access to financing at a reduced cost.

Mr Osman Suleman, Chief Executive Officer, Venture Capital Trust Fund noted that impact investing in the country had chalked out some achievements but saddled with challenges.

He cited some of the challenges as incoherent policies, the country’s Pension Funds inability to invest in Venture Capital or Private Equity, and the lack of research and data to measure performance.

Mr Suleman expressed the need for the generation and dissemination of knowledge and skills development in order to do impact investing more effectively on a larger scale.

He said it is also important for government to prepare SMEs adequately for investment opportunities through the creation of a fund that builds the capacity of ventures to become “investment ready”.

“There is the need to highlight innovations in systems, metrics and tools for monitoring and evaluating the performance of impact investing,” he added.

Dr Edward T. Jackson said the workshop aimed at exploring how field of impact investing could be expanded in Ghana and West Africa thereby achieving significant contributions in addressing social and environmental challenges.

According to Dr Jackson, the workshop would also examine the cost effective methods and tools available in evaluating the success as wells as improve performance of impact investing in funds and programmes.

Source: GNA