West African capital markets integration underway

The first direct trade between Ghana and Nigeria under the phase one of the West African Capital Markets Integration Council (WACMIC) has successfully been completed.

The WACMIC is the apex governance organ for integrating the West African capital markets.

The pioneering trade was transacted between United Capital Securities, Nigeria and CAL Brokers, Ghana and enabled by the Nigerian Stock Exchange (NSE) and the Ghana Stock Exchange (GSE).

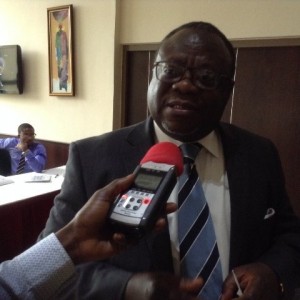

Mr David Tetteh, Chief Executive Officer, CAL Brokers, told the media after a sensitization workshop for stock brokers in Accra, that the success of the first phase was very crucial to pave the way for the remaining phases of the integration process.

He said the first phase of the integration involved sponsored access for stockbrokers, meaning a stockbroker in any of the jurisdictions could have access to other markets outside their own, but through a local broker.

“We are happy to have laid the foundation blocks for this great initiative and we look forward to the overall success of the WACMI. After pioneering Direct Market Access (DMA) in 2009, CAL Brokers is extremely proud of its continued role in the deepening of Capital Markets in the West African sub-region,” he said.

Mr Tetteh, who is also a member of WACMIC’s Technical Committee, said the successful implementation of Phase one would allow Brokers in WACMI member countries to trade on behalf of their clients and settle securities through local sponsoring brokers.

He said the harmonization of these markets would lead to many benefits for stakeholders, including investors, companies, operators and regulators, adding that, the integration will speed up the development of the various domestic financial systems, promote increased competition and innovation.

Mr Tetteh said the integration programme was being implemented in three phases namely; sponsored access, phase one; Direct Access to Qualified West African Brokers (QWABs), phase two; and Integrated West African Securities Market (WASM), phase three.

“I believe that access to a wider market, which integration provides, could encourage more companies to embrace the capital market for funds and listing and further deepen the regional markets,” he said.

Mr Ekow Afedzie , Deputy Managing Director, Ghana Stock Exchange said the integration of West African capital markets would enable companies listed in stock exchanges of every West African country access to a deeper pool of capital in markets across West Africa.

“Likewise, investor member countries can through a licensed issuing house or broker raise money or trade in stock exchanges across West African countries,” he said.

“Successful integration will provide more choices of financial products provided to regional and foreign investors; and increase the sub-region’s integration with the global economy,” he added.

Mr Afedzie said as the world becomes a global village with technology, market integration encourages more companies to list on the exchanges.

“As investors are provided the opportunities to raise capital across the continent, it also offers opportunities to have sub-national shareholders,” he said.

The West African Capital Markets Integration (WACMI) programme is the over-arching initiative of the West African Capital Markets Integration Council (WACMIC), which is being implemented in collaboration with ECOWAS Commission and the West African Monetary Institute.

The primary role of WACMIC is to spearhead the integration of capital markets in West Africa and promote strong relationships among the member states.

Source: GNA