Afreximbank approves $2b loan facilities to Ghana government

The African Export-Import Bank (Afreximbank) says it has approved loans to the tune of $2 billion to Ghana.

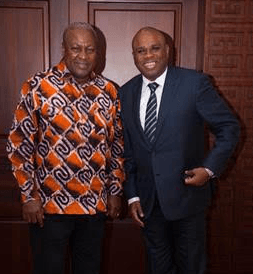

In a press release issued in Accra July 3, 2015 and copied to ghanabusinessnews.com, Dr. Benedict Oramah, President Designate of the Bank who is in Accra, announced that Afreximbank had approved financing totaling about $2 billion for the Ghanaian government, corporates and financial institutions since 1993, with annual approvals increasing from $6.5 million in 1994 to $280 million in 2014.

“As at October 2014, Ghana was the sixth largest beneficiary of the Bank’s funding programmes,” Dr. Oramah was cited as saying. He also noted that the support had been mainly directed toward the energy sector, the financial sector, the agro-processing and industrial development sectors and to the promotion of higher local value-added in Ghana’s extractive industries.

The credit facilities provided by the Bank included a $150 million loan facility to the Volta River Authority to support capacity expansion and refurbishment activities and a further $300 million facility under negotiation; $70 million to a Ghanaian company to enable it offer mining and engineering services to international mining companies; $100 million to the Bank of Ghana to address short-term liquidity challenges; and $70 million to two Ghanaian-owned cocoa processing companies, he said.

President John Mahama according to the release, highlighted the increasingly important roles of those sectors in the country’s economy and also called on the Bank to increase its involvement in Ghana’s manufacturing, construction, renewable energy and other key sectors.

The President was cited to have urged the Afreximbank to further strengthen its trade finance support to the Ghanaian business sector, particularly in the areas of agro-processing and pharmaceuticals.

By Emmanuel K. Dogbevi