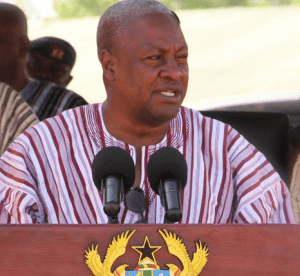

Provide appropriate environment to address challenges – Mahama tells insurers

The President John Dramani Mahama has urged the insurance industry in West Africa to provide appropriate legal and regulatory environment for products to address the challenges of the poor.

“You as insurers will have to work diligently to ensure that the financial sector in general and the insurance industry in particular regain the confidence of the public by meeting your obligations when you are called upon to pay claims,” he said.

President Mahama said this in a speech read for him by the Deputy Minister of Finance, Mrs Mona Quartey, at the 37th Annual General Meeting and Education Conference of the West Africa Insurance Companies Association (WAICA) on Monday, in Accra.

The conference, on the theme, “Africa Rising, Taking the Insurance Industry in West Africa to the Next Level of Our Development,” brought together industry players from Ghana, Liberia, Nigeria, Sierra Leone and the Gambia.

The three-day conference would examine the role of the Insurance Supervisory Authority in a changing socio-economic and political environment, and micro-insurance, as one of the tools to raising standards of living, after the Ebola Epidemic on the continent.

President Mahama said access to appropriate insurance products and schemes contributes to reducing vulnerability and providing the living standards of the marginalised populations, and that in turn engenders inclusive growth and sustainable development.

“Another important area you should address your minds to as industry, is the agricultural sector and the effects of climate change, since the sub-region is prone to adverse weather conditions,” he added, and pledged government’s commitment to support the insurance industry in Ghana, as part of efforts in transforming the financial sector.

He noted that priority areas include the review of the current legislation to address various limitations and to better support product development for critical sectors.

“In this regard, government will continue to promote the micro insurance and agriculture insurance development,” he said, and called on the industry to also complement government’s efforts in social security and social interventions programmes to provide relief for the vulnerable segment of the population and the most affected in society.

President Mahama challenged them to strengthen their technical, financial and distribution capacity to make their products and services accessible and affordable to the poor, vulnerable and the large number of the people operating in the informal sector of the economies.

Miss Lydia Lariba Bawa, the Commissioner of Insurance, said capital inadequacy in the West African Insurance Industry results in low premium retentions and high demand for overseas reinsurances leading to excessive premium flights running into millions of dollars every year.

“Taking the West African insurance to the next level of our development also requires that insurance companies implement sound Corporate Governance and Risk Management systems in line with international best practice to deal with the cultural and behavioural challenges that inhibit the growth of the sector,” she said.

She noted that until a suitable and innovative ways of reaching out to the informal sector is developed, it would be extremely difficult for them to take insurance to the next level of development.

Mr Momoh H. Fortune, the President of WAICA, said regardless of the adverse situation, occasioned by the Ebola Virus disease, which negatively impacted economies of the region, the industry in the various countries of the region continued to provide services.

“Nevertheless, challenges being faced by companies in the industries of individual countries of the sub region, which are cardinal to the development and growth of our industry will be given serious consideration during this conference,” he said.

He said the theme was intended to enable the insurance industry in West Africa to focus on preparing itself for the challenges ahead.

Source: GNA