The way artificial intelligence transformed forex trading

Artificial intelligence has changed Forex trading dramatically. This is due to the emergence of algorithmic trading.

Artificial intelligence has changed Forex trading dramatically. This is due to the emergence of algorithmic trading.

That means all trading decisions are made by a special program called an advisor. It may be a very powerful tool capable of a number of features, say EOS price forecast. Of course, all the criteria for entering and exiting a trade must be clearly spelled out in the trading algorithm. As in any well-established process, there is a narrow specialization in algorithmic trading:

A trader creates their own strategy and gives the task to a programmer

The programmer implements this strategy in a programming language integrated with the trading terminal.

The trader is not required to have programming skills, and the programmer does not have to be a trader. The best result is achieved when the same person combines both skills, but this is often not the case. After the program is ready, it is necessary to test it on historical data. Usually, some variable parameters of the algorithm will have to be optimized. This helps to achieve more profitable algorithmic trading. You can optimize the settings for technical indicators, risk management, etc.

But even after optimization, there is no guarantee that the profitability of algorithmic trading will be close to the test results. The market is constantly changing, and large profits in the past do not guarantee success in the future. Therefore, it is recommended to adjust the algorithm from time to time to adapt it to the changing market. However, the program has great advantages over a person:

- The program does not get tired;

- The program does not make rash decisions;

- The program does not try to “recoup” after losing trades.

With the development of algorithmic trading, a lot of approaches have appeared to automate the process of creating a trading program. These are sometimes referred to as “programming without programming.” Since ordering the creation of a good trading program is quite expensive, not everyone can afford it. The good news is that there are plenty of applications, allowing even a beginner to create a completely professional program for algorithmic trading. The applications that help implement this approach are called forex generators. There are 3 general ways they work:

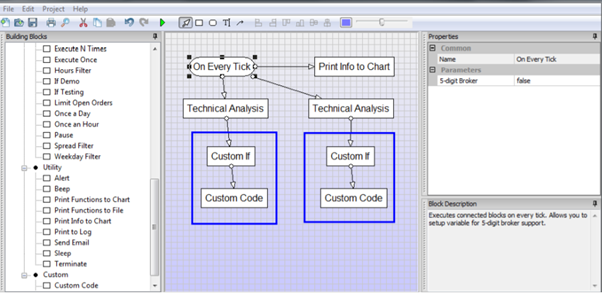

The developer draws a flowchart of the algorithm with condition checks, multiple choice, branches, loops, etc. Then the code generator processes this flowchart and creates the text for the program in the programming language. Finally, the compiler turns this text into an executable. This is how the Forex EA Generator program from Etasoft company works. Using this program, you can create an algorithmic advisor for the MetaTrader terminal quite easily. As a result, Forex EA Generator generates a program in the MQL language (mq4 or mq5). It is loaded into the Meta Editor, where it is compiled into an Expert Advisor file (ex4 or ex5).

The developer loads the history of their deals into a special program to analyze and create an original strategy. In the next stage, the trader can use this strategy to generate the text for the trading advisor. Then this text is compiled to achieve the executable code. A good, if not the best, example of this approach is demonstrated by the well-known Czech company Strategy Quant. The history of trader deals is analyzed by the Quant Analyzer program. It allows users to find weaknesses in a strategy to improve it. Then the AlgoWizard program turns this strategy into a program code, and this process does not require any programming knowledge from the trader.

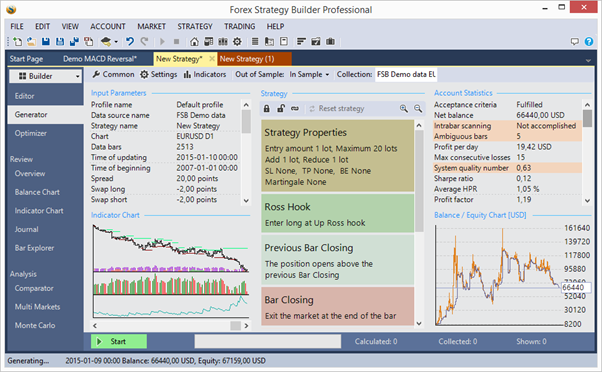

The program analyzes the history of quotes and then generates a trading system that provides the highest profitability from a variety of options. This is how the Forex Strategy Builder from the Bulgarian programmer Miroslav Popov works. The program selects suitable technical indicators, optimizes their settings, and generates code for MetaTrader. Alternatively, the same program can be integrated with the terminal and make trades without using a compiled expert advisor. Despite having a very user-friendly interface, visual effects, a powerful strategy optimizer, and a lot of statistical functions, the effectiveness of this program is not high: it will adjust the trading strategy to the history of quotes in the past, but such a strategy does not work very effectively on new data.

The question arises: how effective is algorithmic trading compared to manual trading? Such comparisons are made regularly, but there is no clear answer. It is difficult to compare the results of short-term and long-term trading. You can achieve very high profits on short-term trades but then lose them in a series of continuous losses. Conversely, careful long-term trading with low leverage can be more effective. Only time can show the correctness of each trading style. However, a reasonable compromise is important here. You can create the perfect program by spending years on it, or you can earn real money during this time.

A lot of forex brokers hold regular algorithmic trading championships with large prize pools. Such championships attract not only the authors of the programs who are striving to win prizes. Algorithmic trading championships are a good opportunity for programming studios to improve their products, such as trading terminals and integrated programming languages.